新闻文章

启迈QIMA 2025 年第三季度行业报告:美国陷入关税战泥潭之际,场外新贸易关系正在形成

或随时随地收听我们的“供应链声音片段”播客

2025年第二季度的全球贸易情绪在很大程度上受到近期美国贸易政策根本性转变的主导。 然而,即使关税冲击扰乱全球供应链,长期采购趋势依然持续生效。 在品牌商、政府和消费者应对持续贸易战余波之际,启迈QIMA最新一期行业报告审视了短期采购波动如何融入全球贸易大局。

经历初期关税动荡后,美国供应链为旺季潜在干扰做准备

尽管美国政府2025年第二季度的关税政策几经急转,美国品牌商和零售商的采购模式大体仍维持在年初贸易紧张升级前确立的长期趋势范围内。

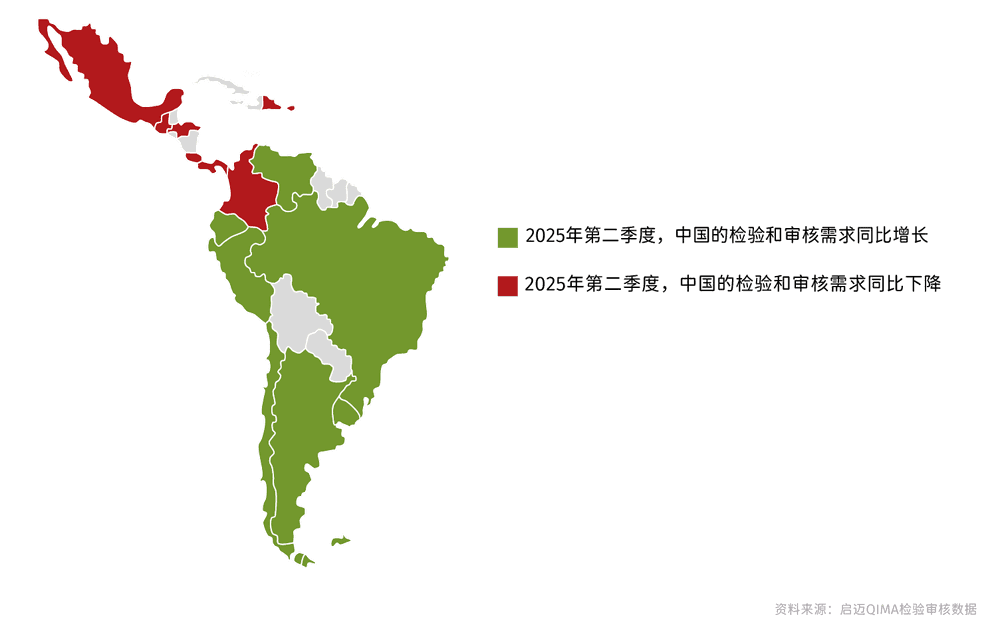

启迈QIMA数据显示,2025年第二季度,美国买家对中国检验和审核的需求同比下降24%,同时在东南亚主要供应市场则增长29%。然而,此转变并非新现象:自2023年年中以来,随着中国份额逐渐缩减,东南亚在美国采购来源中的占比一直在稳步增长(见图1)。这表明,目前从越南、印尼和菲律宾采购的增加,是美国供应链持续多年从中国地区向外调整的一部分。

尽管如此,未来数月可能令美国供应链面临新考验。针对大多数非中国国家的临时关税暂停将于7月到期,恰逢假日季采购启动,在旺季伊始就给美国供应链带来新的压力。

图1:中国与东南亚在美国采购来源中的相对占比 – 季度趋势

资料来源:启迈QIMA检验审核数据

美国关税紧张局势下,中国深化与欧盟贸易联系

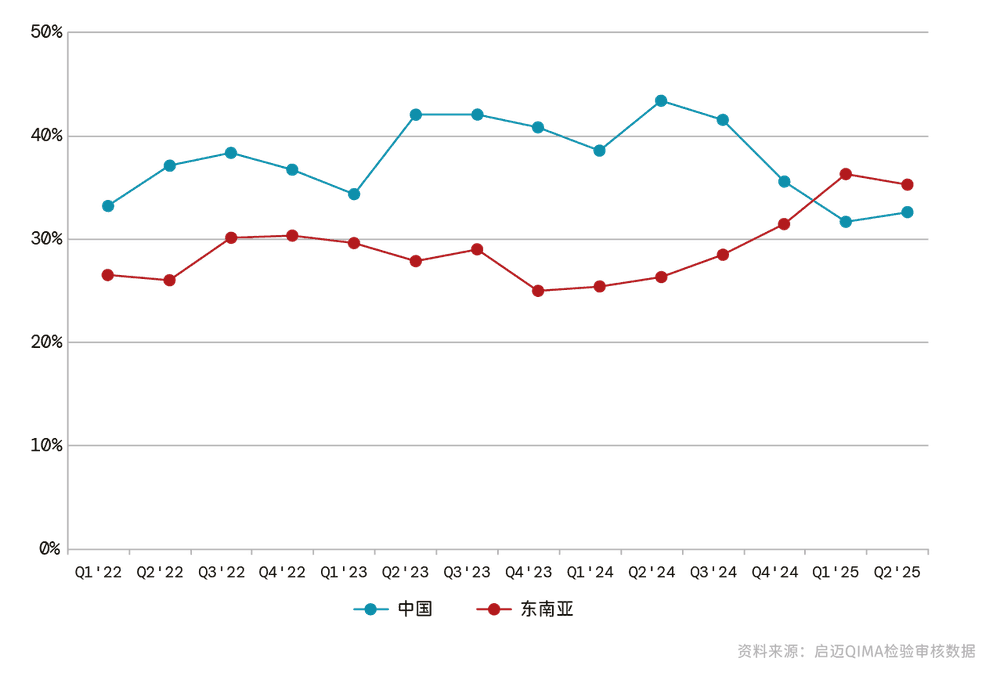

尽管6月达成了暂时休整,持续的美中贸易冲突已在塑造中国的全球供应链战略。启迈QIMA最新检验和审核数据显示,中国可能正在加强与美国以外发达经济体的经济联系——尤其是与欧盟之间。

2025年第二季度,欧洲品牌商和零售商对中国产品检验的需求同比增长5%,同时中国在其采购组合中的占比也有所上升。值得注意的是,荷兰(同比+27%)和奥地利(同比+21%)的需求激增,西班牙(同比+6%)、波兰(同比+5%)和德国(同比+4%)也呈现温和增长。

在行业层面,玩具和休闲产品成为最强劲的增长驱动力。启迈QIMA数据显示,2025年第二季度欧洲买家对这些品类的检验需求同比飙升24%——这清晰表明,尽管持续进行多元化努力,欧盟在采购某些关键消费品方面仍继续依赖中国。

图2:美国与欧盟买家采购中中国占比的变化

资料来源:启迈QIMA检验审核数据

消费者信心复苏,欧洲买家加速东南亚采购

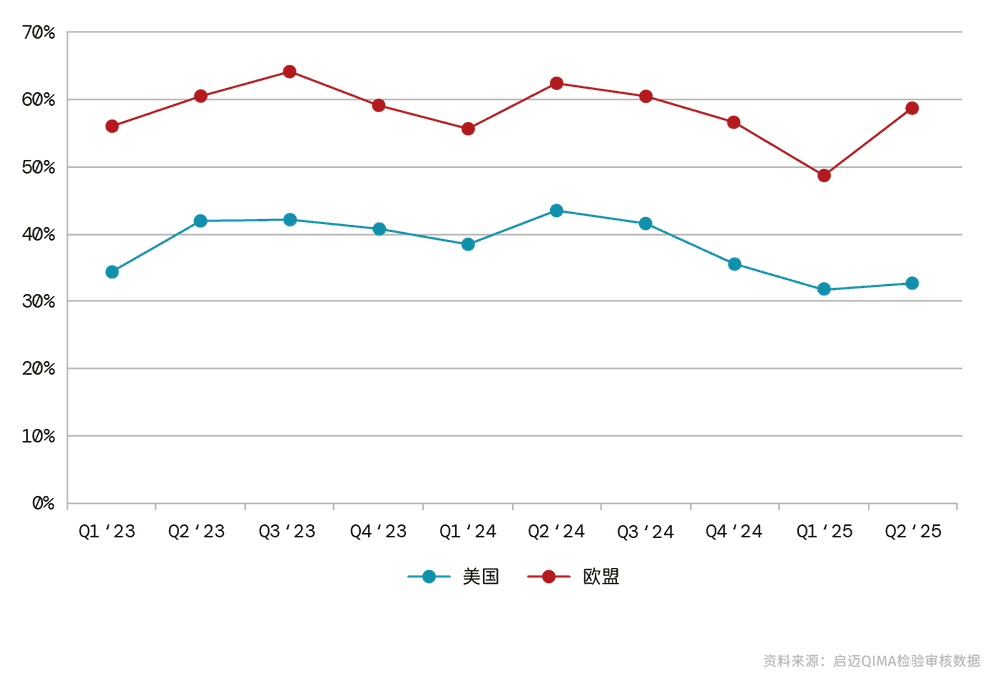

除对中国制造业重燃兴趣外,在稳定的消费者情绪的鼓舞下,欧洲品牌商和零售商正在其本土区域及海外扩大采购力度。

启迈QIMA数据显示,2025年第二季度欧盟对东南亚检验和审核的需求同比增长13%,其中柬埔寨(同比+9%)、越南(同比+16%)和泰国(同比+29%)占据了新增业务的最大份额。纺织和服装行业表现突出,需求同比增长 21%,超过了该地区的平均水平。

近岸采购(Nearshoring)仍是欧洲采购战略的核心。22025年第二季度,整个欧盟近岸采购和回岸采购(Reshoring)市场的检验需求同比增长18%,地中海沿岸采购尤其活跃。随着品牌商持续多元化其供应商组合,摩洛哥(同比+53%)、埃及(同比+73%)和突尼斯(同比+35%)在本季度成为首选目的地,成功与土耳其竞争,后者引以为傲的纺织业今年正面临一些阻力。

图3:欧盟主要采购区域 – 按相对占比

资料来源:启迈QIMA检验审核数据

区域内贸易凸显拉丁美洲和南美洲增长潜力

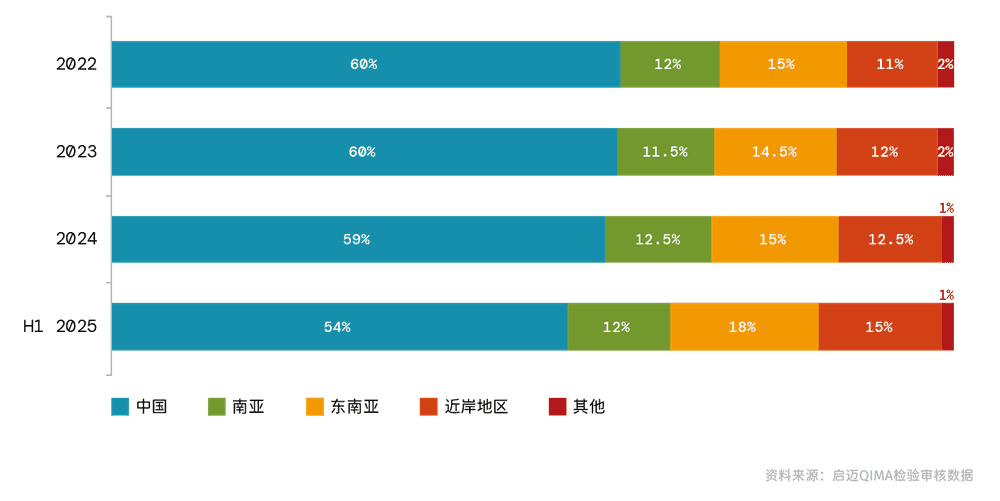

继年初强劲开端之后,拉丁美洲和南美洲的采购趋势再次证明,该地区的潜力远不止于成为美国的近岸采购地 。

启迈QIMA数据显示,尽管2025年第二季度美国对拉丁美洲和南美洲检验和审核的需求同比下降9%,但同期全球对该地区采购的需求同比增长8%。这一显著增长的重要驱动力是区域内贸易,来自墨西哥、哥伦比亚、秘鲁、智利、萨尔瓦多和多米尼加共和国的供应商从本地买家获得了强劲的业务。

这些模式,尤其是在该地区与中国关系日益深化的背景下,突显了在持续不确定性拖累的全球经济中,南南贸易(South-South trade)的重要性正日益上升,这种经济关系的加深在全球经济增长不确定性环境下变得越来越重要。

图4:2025年第二季度拉丁美洲和南美洲对中国检验和审核的需求情况

资料来源:启迈QIMA检验审核数据